So, Can I Go To Jail For Not Paying A Loan?

- No, you will not go to jail for not paying a loan

- Standard attempts to take payment will first be made first

- The lender will contact you by phone, email and post

- Interest and fees may apply

- Your credit score can be affected

No, you will not end up going to prison if you do not keep up with repayments on a payday loan. Whilst you may be worried about accumulated debt and the consequences, you can rest assured that prison will not be a repercussion.

Lenders understand that events can occur that mean you are unable to pay back the loan you originally took out. However, if you are having problems with repayments this must be communicated to your lender as early as possible. All payday lenders in the UK are regulated and they have systems in place to keep people who cannot repay their payday loans – and this might include offering payment plans or freezing interest.

We explain the typical ways in which a lender will try to collect payments for a payday loan.

The lender attempts to collect money from your account

You would scheduled a repayment date for collections when you applied and this will be confirmed in your loan agreement that you electronically signed.

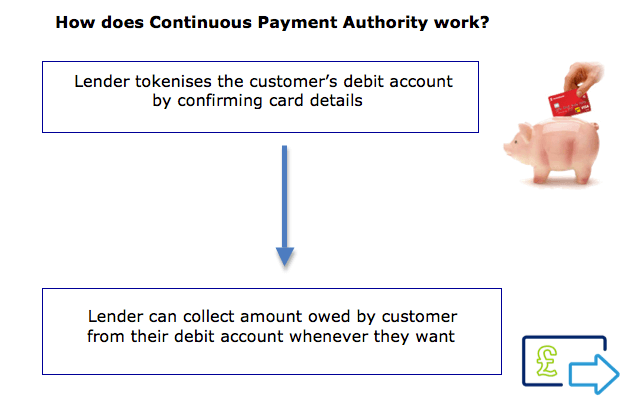

Usually, the loan payment is automatically debited from your account with interest through a a recurring payments system known as continuous payment authority.

Payments will be attempted to be taken for a specific amount of time, and if they are unable to take this amount, the lender will simply get in touch by email, phone and eventually send a letter to your address.

Your lender will attempt to contact you by phone, email and post

If the payment for your loan does not go through, the lender will try to contact you by phone, text or email.

In the event you do not respond to these contact attempts, the lender may then send follow up letters too.

This is why you should contact the lender directly if you know you are having difficulties with paying the loan back. The lender will then stop sending you additional emails, calls and texts and can work with you to find a suitable arrangement.

This may mean an alternative plan that lowers your monthly payments over a longer period of time, or interest is temporarily frozen whilst you get back on track.

If you are not satisfied with the end result of contacting your payday lender, you can also contact one of the free independent debt advice services in the UK or the financial ombudsman, for further advice.

Interest is added to missed payments

If you do not pay back a payday loan and fail to inform the lender as to why, you can accrue interest on the outstanding balance.

In terms of what you will end up paying, this depends on the loan amount you have taken out. However, the Financial Conduct Authority (FCA) has enforced regulations that mean payday loan firms can only charge daily interest of up to 0.8%. This ruling has been in place since January 2015 to ensure fair practices are implemented.

A default charge could be applied

Failing to repay your payday loan could mean you need to pay a one-off default charge. This has also been capped by the FCA, as previously lenders could choose how much they charged.

Now, if a customer is unable to repay the loan promptly or within the first 48 to 72 hours, the lender could add a £15 default fee to the overall outstanding balance.

Your credit score could be affected

If you default on your payday loan repayments this could negatively impact your credit score as it will be reported onto your credit report.

The lender sends any information you have defaulted on payments to the three main credit reference agencies (Experian, Equifax and Callcredit). This will give future lenders a warning that you do not always keep up with repayments and could make it difficult for you to get access to credit in the future if you do not clear the balance.

For any questions relating to going to jail for not paying a loan, payday loans or the terms of your agreement, feel free to contact Badger Loans directly.

Looking for Something Else?

Unsecured Loans | Fast Loans | £1000 Loans | Payday Loans | Personal Loans | Bad Credit Loans | Review Us | Contact Us