Bad credit loans allow those with less than perfect credit scores to access the finance they need. At Badger Loans, we work with a panel of over 30 lenders in the UK who are able to offer loans for people with bad credit scores. This can be done quickly too. So if you need a bad credit loan, you’ve come to the right place.

Customers can apply for up to £25,000 with options to repay over 1 to 60 months in monthly instalments. If you want to repay early, you can do so at no extra cost!

Our online loan application takes less than 5 minutes to be complete and will provide an almost instant decision (around 1-2 minutes). If successful, you could receive your funds within 1 hour. More likely you will get your money within 1-2 days of applying. If you want more info on bad credit loans and maximising your chances of getting one, click here to be taken to our new Finance Guide – Comprehensive Guide to Bad Credit Loans.

What Is A Bad Credit Loan?

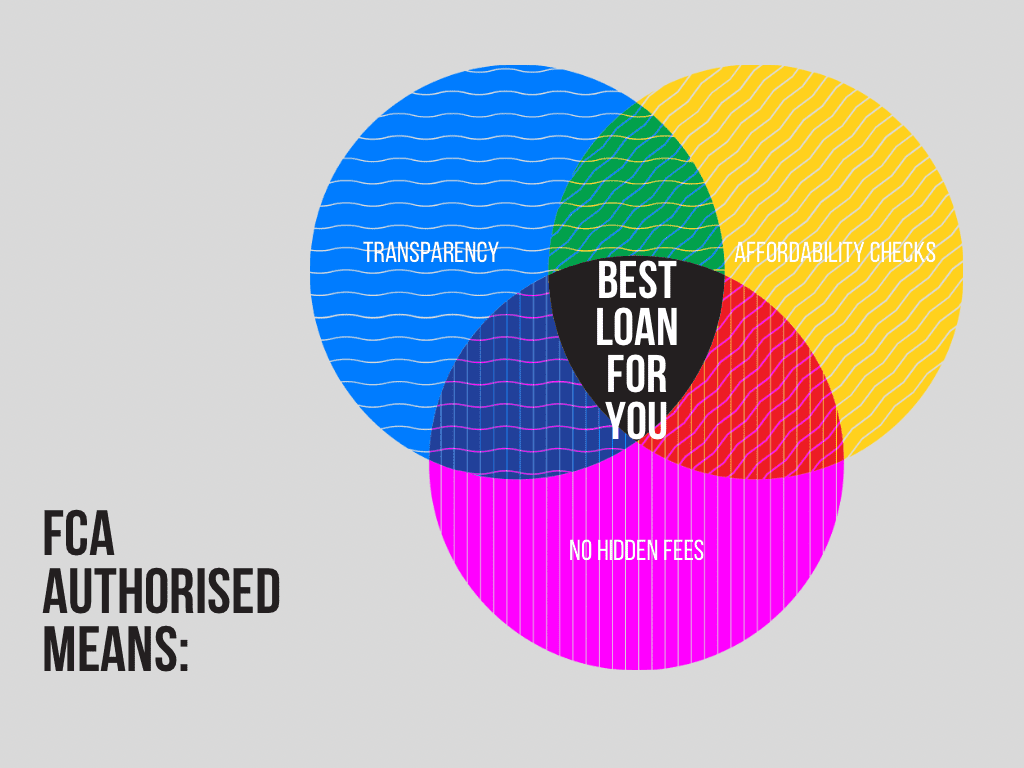

Bad credit loans are specifically designed for individuals who have struggled with credit in the past. Whether you have defaults, CCJs, or missed payments, a bad credit loan allows you to access finance when traditional lenders might turn you down. At Badger Loans, we work with responsible lenders who understand your situation and are willing to look beyond your credit score. This means we can offer you the best rate possible for an affordable monthly payment.

Why Choose Badger Loans?

- Wide Range of Lenders: We partner with over 30 lenders to give you the best chance of approval.

- Quick Decisions: Our online application takes less than 5 minutes, with decisions typically within 1-2 minutes.

- Flexible Loan Amounts: Borrow from £1,000 to £25,000, with repayment terms ranging from 1 to 60 months.

- No Impact on Credit Score: Our initial soft search won’t affect your credit score.

- No Upfront Fees: Apply without worrying about hidden fees or upfront costs.

How to Apply for a Bad Credit Loan

Applying for a bad credit loan with Badger Loans is simple and straightforward:

- Start Your Application: Click on the ‘Apply Now’ button and fill out your basic information. You will be required to provide some basic information including your name, age, address, income, expenses and bank details so the lender knows where to transfer the funds to.

- Get a Quick Decision: Our system matches you with the best lender for your needs and provides a decision within minutes.

- Receive Your Funds: Once approved, funds could be transferred to your bank account within 1 hour, though most customers receive their money within 1-2 working days.

Who is Eligible for Instant Bad Credit Loans?

You could be eligible for a bad credit loan if you:

- Are over 18 years old and a UK resident

- Have a regular income and can afford repayments

- Have a credit history with recent defaults, CCJs, IVAs, or missed payments

We understand that financial emergencies happen. If you meet the criteria, we’ll do our best to help you secure the funds you need.

How Can I Get a Loan with Bad Credit?

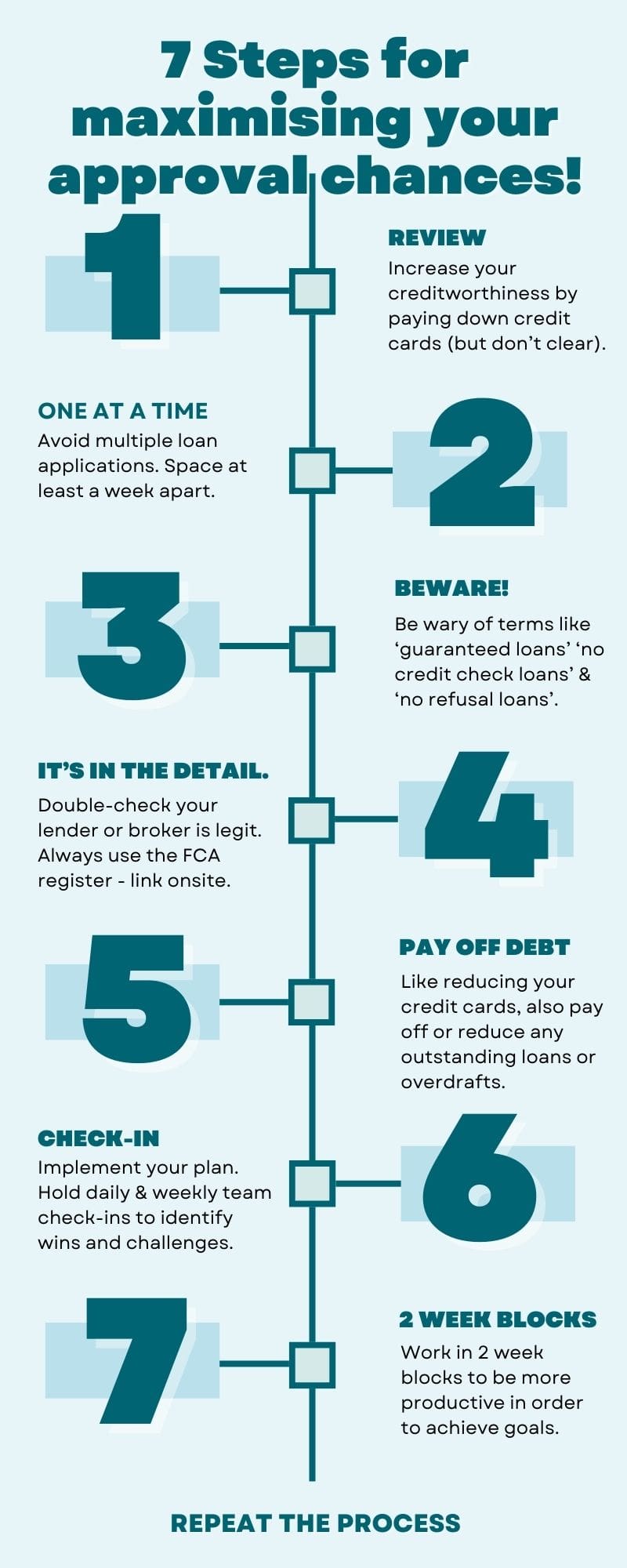

If you have a bad credit score, Badger Loans will be able to match your criteria and requirements with up to 30 responsible lenders in the UK. This will help you boost your chances of approval and get the funds you need. Please remember however, that there is no such thing as a guaranteed loan for bad credit. Certainly not in the UK. As well as there being no guaranteed loans, there is also no such thing as a no credit check loan. Just because you may have arrived here from a search engine using those words, doesn’t make them exist. Any company offering things like no refusal loans, no credit check loans or guaranteed loans probably went bust a long time ago. Either that or they’re trying to scam your money.

How to Improve Your Chances of Approval

While we work hard to find a loan for everyone, improving your credit score can boost your chances:

- Maintain a Regular Income: Stability in your income is key.

- Pay Off Existing Debts: Reduce your current debt load to show lenders you’re capable of managing credit responsibly.

- Register to Vote: Being on the electoral roll can enhance your credibility.

- Avoid Multiple Applications: Applying for several loans in a short period can harm your credit score.

Bad Credit Loans Assessed

Bad credit loans are based on the lender being able to assess risk and maximise their chances of being repaid on time. To manage this risk, the interest rate you pay may be a little higher depending on your credit score. Or the lender may adjust or lower the amount you wish to borrow so you avoid falling into financial difficulty.

To get a loan with bad credit, you can improve your chances by having a regular and stable income. Plus show proof of making recent repayments on time for other financial products such as loans and credit cards. If lenders can see that despite a bad credit score, you are showing an eagerness to repay on time, this will help maximise your chances of approval.

Any other ways you can improve your credit score will also contribute to your success. This could include paying off any existing credit card bills and closing any cards that you do not use. Consider joining the electoral register and avoid making multiple loan applications in a short space of time.

How is Badger Loans Different?

Badger Loans wants to help you get the finance you need at the most competitive rate. We understand how difficult it can be to get a loan with bad credit. It takes time and energy to apply with multiple lenders.

However, our state-of-the-art matching system aims to match your requirements with the lender most likely to approve your application. Thus saving you time and effort. We also set the system to look for the lender who will charge you the least interest. A loan is a loan regardless of what it’s called for marketing purposes. Bad credit loans are no different. They are an amount of money being lent at a certain rate for a specific period of time just like any other loan. Just more expensive.

There are no upfront fees for applying and an application will not impact your credit score. Simply click on our apply now button to receive an instant decision and possibly get access to funds on the same day.

Frequently Asked Questions

What is a bad credit loan? A bad credit loan is designed for people who have struggled with credit in the past. It provides an opportunity to borrow money even if your credit history includes missed payments, defaults, or CCJs.

How quickly can I get the funds? Once approved, you could receive the money in your bank account within 1 hour, though it typically takes 1-2 working days.

Will applying affect my credit score? Our initial soft search won’t impact your credit score. A full credit check is only performed once you accept a loan offer.

Are there any fees? There are no upfront fees for applying with Badger Loans. You only pay the agreed interest rate on the loan you receive.

Can I repay early? Yes, you can repay your loan early at no extra cost, potentially saving on interest.

That’s it! You have come to the end of our offering for Bad Credit Loans. If you’ve read enough to make a decision go to the Apply Now button above and fill out our 2 minute application form. If you are successful a lender will be in touch straightaway and don’t forget – NEVER give anyone money up front to complete a loan application.